There are plenty of incentives to help you make the switch to solar power, but the federal solar investment tax credit is perhaps the most important of them all. However, this incentive is now set to expire at the end of 2025, and the time to take advantage is now.

But what is the solar tax credit? How does it work? Who is eligible? We’ve got all the answers.

What is the Solar Investment Tax Credit?

The solar investment tax credit (ITC), also known as the federal solar tax credit or solar ITC, allows folks with solar to deduct 30% of the cost of installing a solar PV system from their federal taxes. The solar investment tax credit is an important incentive that has played a huge role in the adoption of solar in the U.S.. Not only has it driven down costs, according to the National Solar Energy Industries Association (SEIA), it has also helped the U.S. solar industry grow by 10,000 percent in the last decade.

In 2005, Congress passed the Energy Policy Act which created the solar investment tax credit. Thanks to its popularity and success in transitioning the U.S. to renewable energy, the federal ITC program received many renewals over the years. The most recent extension came in August of 2022 and extended the credit at the 30% rate until 2032. The program would then begin a step-down process in 2033 at 26% and then reduce to 22% in 2024.

However, with the new 2025 congressional budget bill that was recently passed, the federal ITC program is now set to expire at the end of 2025, roughly a decade early and with no step down “glide path.” This means the tax credit is only available until December 31st 2025. Any systems installed after this date will not be eligible to receive the credit. The time to take advantage of solar savings is now.

One gray area could give residential solar and storage projects slightly more runway. The law does not specify that the project must be interconnected by year’s end, so projects that can be fully installed by December 31 but can’t interconnect to the grid until after that date could still potentially collect the ITC.

Who is eligible for the Solar Investment Tax Credit?

Whether you’re a home or business owner, you can take advantage of this credit and there’s no cap on its value. However, it’s important to remember that you must own your solar PV system in order to receive it. The solar tax credit does not apply to leased solar PV systems or power purchase agreements.

All solar PV system owners should be eligible for the solar ITC and eligibility is based on tax liability. The tax credit can be rolled over for a period of five years if the credit amount exceeds your tax liability in a given year. In addition, the ITC program does not have an income limit, which means you may be eligible regardless of your tax bracket.

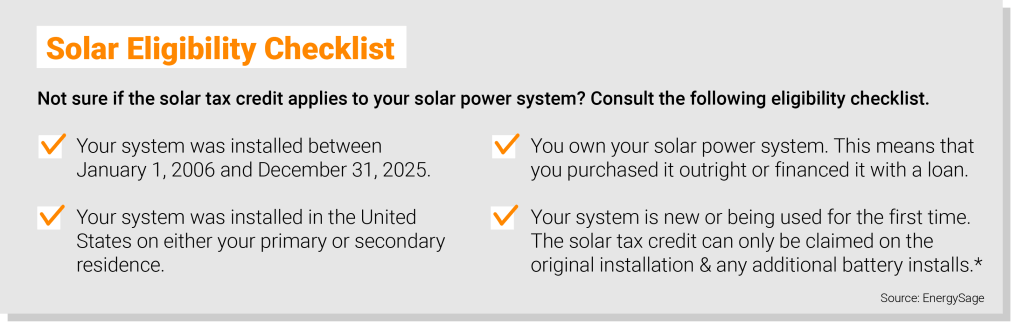

The Solar Eligibility Checklist

*For example, if you purchase a home that already has solar you cannot claim the 30% tax credit on that system. In this situation, you may only claim the credit if you add battery storage to the system.

Source: EnergySage

How does the solar ITC work?

After purchasing a solar PV system, you receive a credit on your federal taxes for 30% of the cost of your system. It’s important to keep in mind that the solar tax credit is NOT a rebate program. Many dishonest solar companies try to convince their clients that they will receive a rebate check for 30% of the cost of their system. This is not true. The solar ITC is a true credit on your federal taxes and you will not receive a rebate check.

The tax credit covers all portions of a solar installation including any battery installs. The 30% credit can also be applied to retroactive battery installs if you decide to add battery to an existing system.

How do I claim the solar ITC?

Solar home or business owners claim the solar ITC when filing their federal tax return for the system’s installation year. For example, if a home or business owner installs solar by December 31st 2020, they will be eligible to claim the credit in their 2020 filing.

We always encourage folks considering solar to speak with their trusted tax professional before signing a contract. Be sure to also let your tax expert know that you went solar so they can assist. If you file your own taxes, check out EnergySage’s step by step guide on how to claim the solar ITC.

It’s important to note that the solar ITC does not increase your federal tax refund. It is a true credit on the amount of taxes you owe to the IRS.

The time to go solar is now! Give us a call or request a quote today!