The passage of the Inflation Reduction Act (IRA) this past year was a huge win for clean energy and renewables. The new policy creates many new programs that incentivize electrification, energy efficiency, and renewable energy adoption.

From tax credit extensions, to new rebate programs, families and individuals can take advantage of these new savings to lower electric bills, achieve energy independence, and reduce their reliance on fossil fuels.

Solar Tax Credit Extension

The Federal Solar Investment Tax Credit (ITC) has been extended at the 30% rate for the next 10 years and will expire in 2032. Home and business owners who install solar will be able to claim a 30% tax credit when they file the following year.

Renewable Energy Tax Credits

The Federal Solar Investment Tax Credit (ITC) was expanded to include a 30% tax credit for battery and geothermal systems. Homeowners who add battery storage to an existing solar power system will also be able to claim a 30% tax credit.

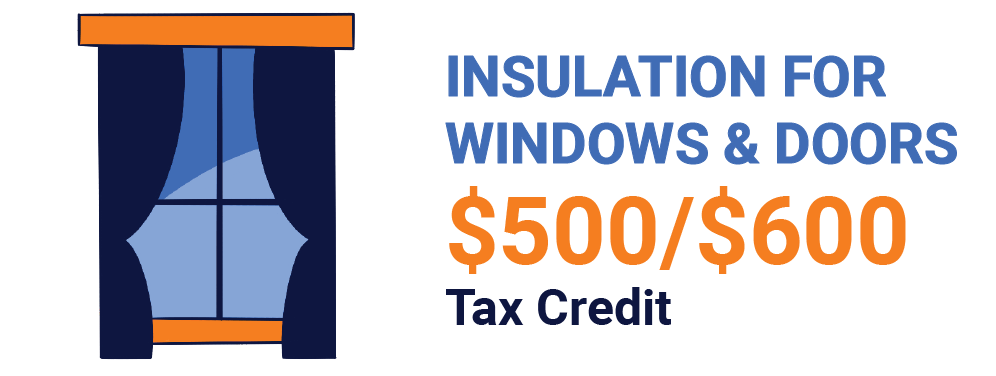

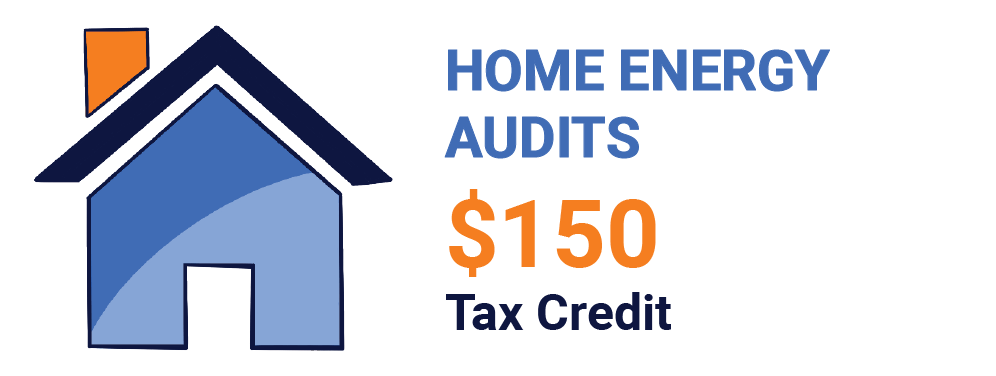

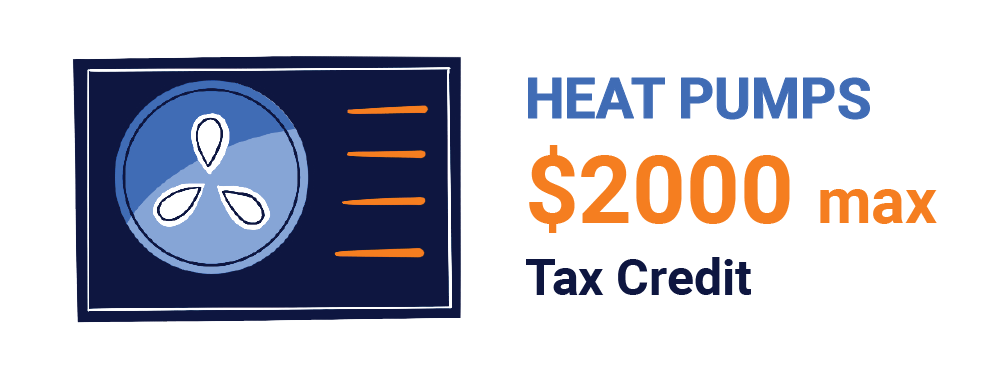

Energy Efficiency Tax Credits

The IRA establishes additional tax credits for energy efficient home improvements that will help homeowners maximize energy savings.

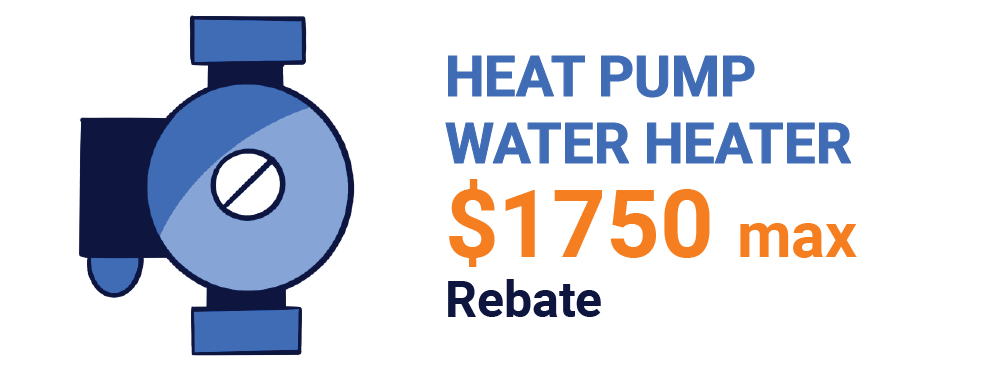

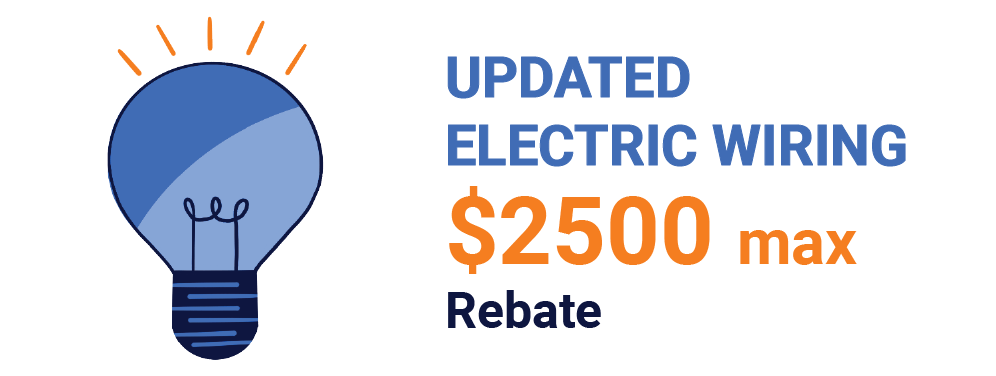

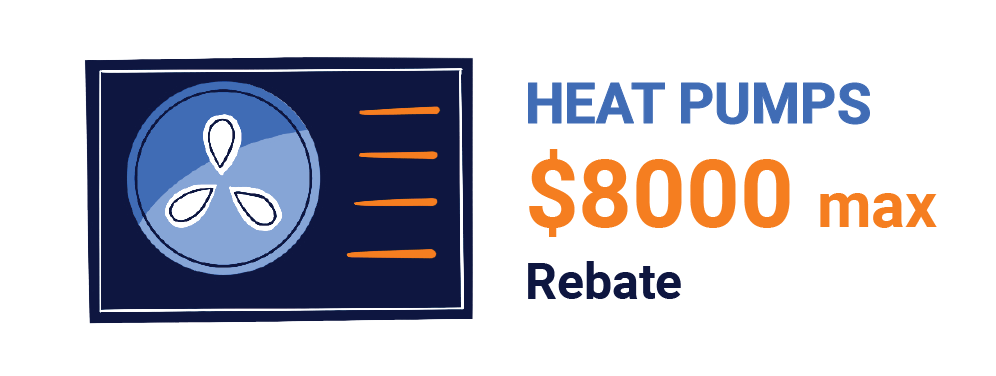

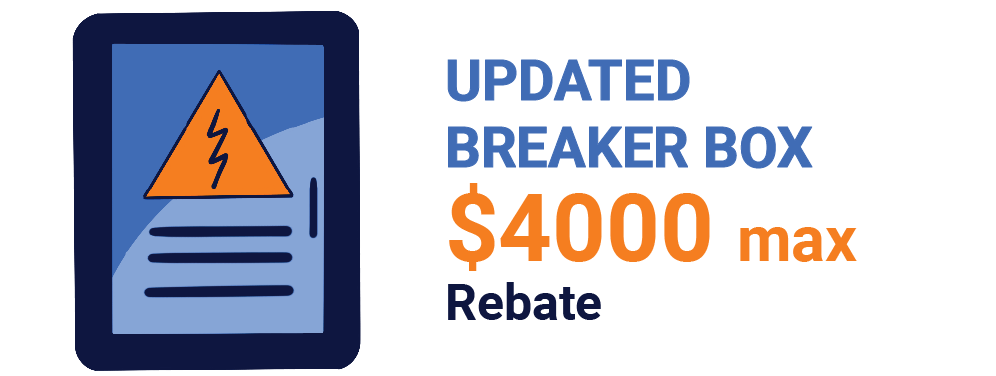

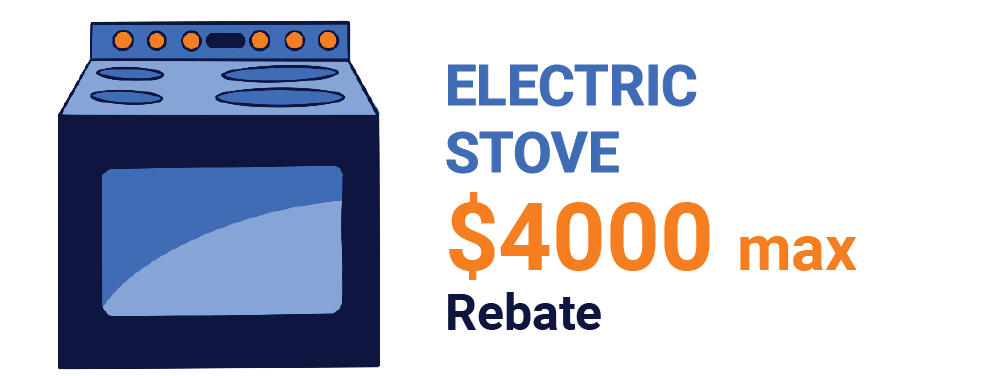

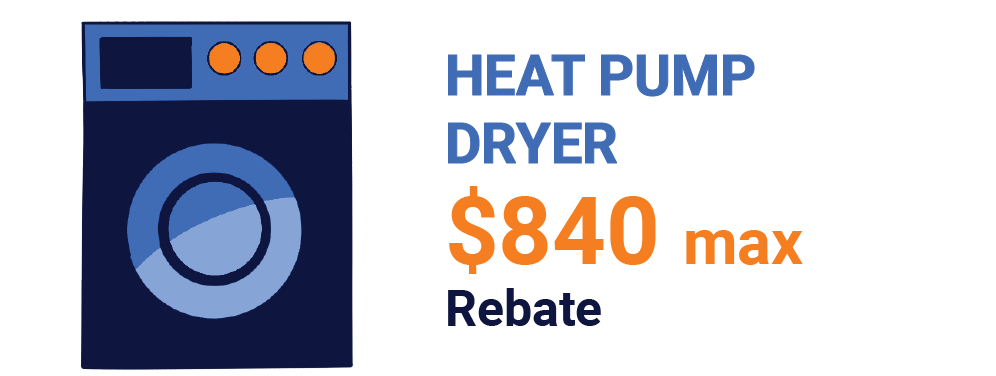

Energy Efficiency Tax Rebates

The IRA establishes new rebate programs for energy efficiency and electrification upgrades. Homeowners can take advantage of direct payments to install specific upgraded efficient equipment. This expansion will also inspire new trends in the industry.

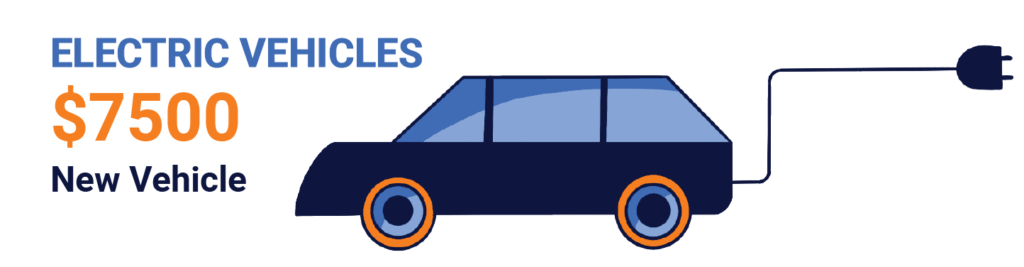

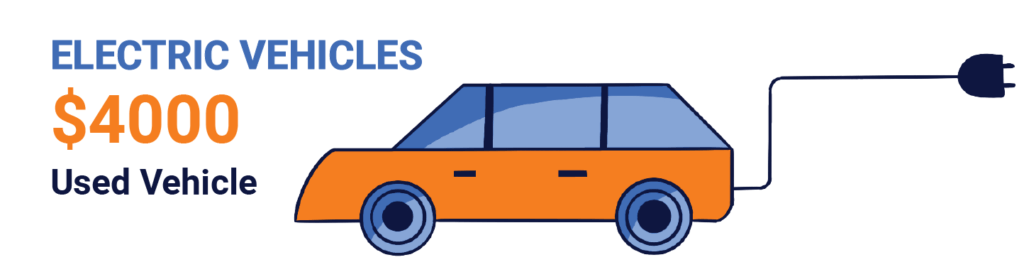

Electric Vehicle Tax Rebates

The IRA establishes new tax rebate programs for both new and used electric vehicles. This encourages families to move away from traditional gas-powered cars. The demand for electric vehicles is also expected to increase solar adoption as more homeowners begin to charge their electric vehicles with the power of the sun.

Have questions about the Inflation Reduction Act and your next solar project? Give us a call. Interested in learning more about a solar power solution for your property? Get a quote.